nespix/iStock via Getty Pictures

Horizon Technologies Finance Corporation (NASDAQ:HRZN) endured a 24% valuation reduce in 2022, and the small business development corporation is now really worth obtaining at reserve worth.

Horizon Know-how Finance is a large-yielding, technological know-how-centered BDC with a yield that just lately surpassed 10%. To aid its growth, the enterprise improvement firm has a secured, financial debt-oriented expense portfolio.

Horizon Technological know-how Finance’s credit score portfolio is accomplishing effectively, and the stock could eventually trade at a greater ebook benefit various.

Yet another Gem In the BDC Sector

Company advancement organizations have suffered significant valuation losses in 2022, owing to investors’ expectation that economic downturn things will have an impression on the sector’s potential customers for e-book value growth.

For the duration of recessions, it is far more tough for enterprise improvement corporations to deliver constructive advancement in important metrics these kinds of as internet investment revenue (thanks to portfolio profits pressure) and reserve worth (due to force on credit score quality which tends to raise throughout recessions).

With that claimed, I believe it is time for dividend investors to target BDCs that, due to their credit history overall performance and floating charge exposure, have the prospective to outperform the sector.

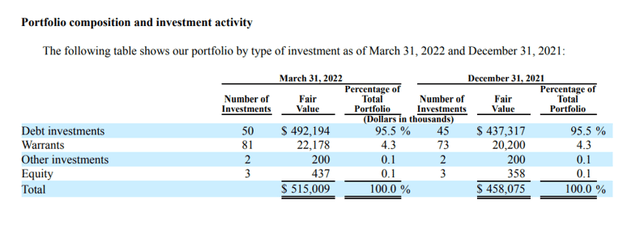

Horizon Engineering Finance is a monthly-spending specialty finance enterprise with a promptly expanding investment decision portfolio. The portfolio experienced 50 personal debt investments and 81 warrant positions as of March 31, 2022.

Personal debt investments designed by the BDC are commonly Senior Expression Financial loans that provide the BDC with a substantial amount of capital defense. In March, the firm’s debt, warrant, and equity positions were valued at $515 million, and the BDC was invested at a 12.4% annualized average portfolio yield.

Portfolio Composition (Horizon Technological innovation Finance)

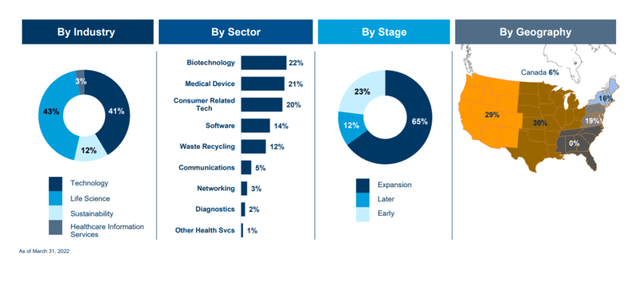

Horizon Know-how Finance is an interesting dividend financial commitment because it generally invests in progress-stage organizations in the technological innovation, existence science, health care info, and providers industries, and it participates in the upside of those companies by fairness and warrant positions.

Horizon Know-how Finance is related in lots of ways to Hercules Funds, a different BDC that seeks to capitalize on equity upside in distinct technology niches.

Horizon Technological innovation Finance has developed and nurtured a know-how-aim in venture cash, which is exactly where the BDC sees the biggest prospect for substantial returns. The BDC is nicely-diversified and steers clear of cyclical industries that pose earnings and dollars stream hazards. Biotechnology as an field accounts for 22% of the BDC’s complete industry publicity.

Investments Overview (Horizon Engineering Finance)

NII Exceeds Distributions

Horizon Technological innovation Finance’s portfolio created $1.41 for every share in net expenditure cash flow in 2021, though BDC paid out out $1.25 per share, implying an 89% fork out-out ratio. The dividend spend-out ratio was 90% from 2019 to 2021, so buyers can moderately suppose that the $.10 for every share month to month dividend is sustainable.

Sail By means of The Upcoming Fascination Charge Climbing Cycle With Horizon Know-how Finance

The central bank is aggressively elevating fees, making now an superb time to decide on BDCs with the best volume of floating rate exposure.

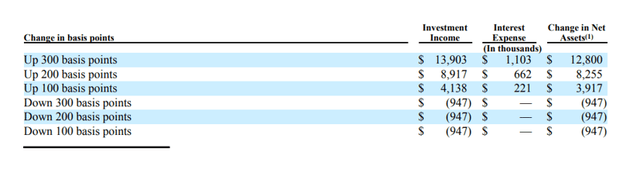

Horizon Technological know-how Finance structures its finance deals cautiously to make certain 100% floating rate exposure, which signifies HRZN has additional floating amount exposure than the normal company progress firm in the sector.

This means that a significant raise in desire premiums will reward Horizon Technological innovation Finance far more than other BDCs. Dependent on the BDC’s interest sensitivity desk, a 200-basis-issue boost in fascination costs is predicted to result in a $8.26 million raise in Horizon Technological innovation Finance’s internet belongings.

Fascination Sensitivity (Horizon Engineering Finance)

Buying and selling At E book Benefit

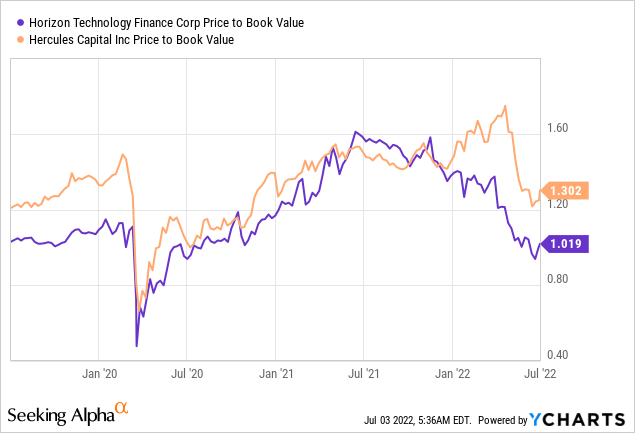

Because of their similarities in targeted industries and deal constructions, I think Hercules Capital is the greatest similar for Horizon Technological know-how Finance. Hercules Money has a P/B ratio of 1.3x, owing to the BDC’s enormous accomplishment with its tech-targeted financial commitment technique that combines fascination payments with equity upside.

Since the market place rewards HTGC for the regularity of its portfolio final results, the BDC trades at a high quality to guide worth. Horizon Technological know-how Finance now has a P/B ratio of 1.0x, implying that HRZN may possibly be a superior acquire than Hercules Money dependent exclusively on guide benefit.

Are There Any Asset High-quality Issues?

Correct now, I never see any important concerns. Horizon Engineering Finance had 1 personal loan that was earlier thanks as of March 31, 2022. The price tag of this expense was $11.9 million, and the truthful benefit was $5.5 million. On a honest price basis, the non-accrual ratio was about 1%, primarily based on the total portfolio value of $515 million.

Why Horizon Technologies Finance Could See A Reduced Inventory Rate

To obtain up-to-date data about Horizon Engineering Finance’s portfolio overall performance, buyers should closely keep track of the BDC’s e-book worth pattern and non-accrual ratio. With only a single non-accrual investment decision, I might say portfolio top quality is potent, but issues can often transform for the worse, particularly if the BDC sector is destabilized by a recession.

My Summary

Now that Horizon Technological know-how Finance is trading at e-book worth, the proposition will become more desirable.

HRZN is one of the very best bets in the BDC sector for growing fascination fees because it is 100% exposed to floating costs.

The dividend is lined and reasonably risk-free, although non-accruals are held to a minimum.

Horizon Technology Finance is distinguished by its technological concentrate, and equity appreciation benefits in the payment of special dividends.

More Stories

Online News – Pros and Cons

February Forecast – Uranian Style Astrology

Forex Trading Strategies – Developing a Strategy to Make Triple Digit Gains