In purchase to justify the effort and hard work of choosing specific stocks, it is really value striving to beat the returns from a industry index fund. But even the very best stock picker will only get with some selections. So we would not blame long expression Global Enterprise Devices Corporation (NYSE:IBM) shareholders for doubting their choice to hold, with the inventory down 16% more than a half decade.

If the earlier week is just about anything to go by, investor sentiment for Global Small business Machines just isn’t optimistic, so let us see if there is certainly a mismatch involving fundamentals and the share value.

Test out our most recent investigation for Intercontinental Small business Devices

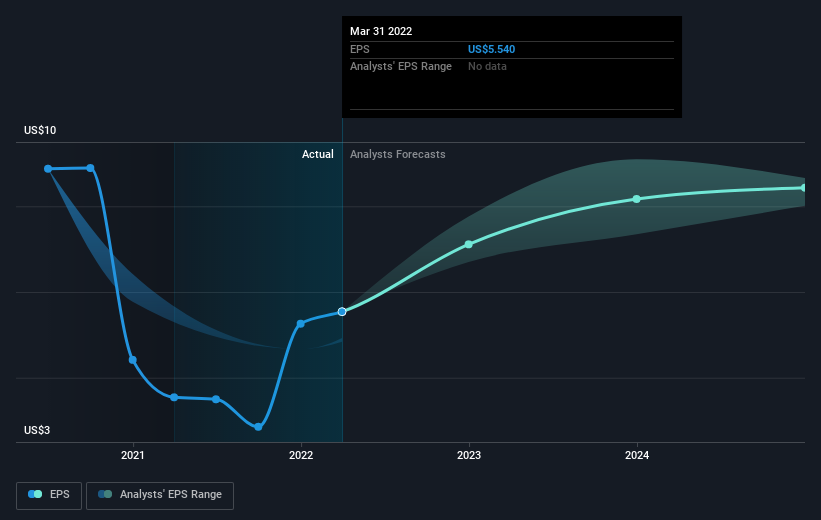

Although markets are a powerful pricing system, share price ranges mirror trader sentiment, not just fundamental small business overall performance. A single flawed but realistic way to assess how sentiment about a company has transformed is to look at the earnings for every share (EPS) with the share price tag.

On the lookout again five decades, both Intercontinental Enterprise Machines’ share value and EPS declined the latter at a price of 15% per year. This fall in the EPS is even worse than the 3% compound once-a-year share value drop. So the industry might previously have expected a fall, or else it expects the predicament will enhance.

The graphic underneath depicts how EPS has altered more than time (unveil the exact values by clicking on the impression).

We know that Intercontinental Business enterprise Devices has enhanced its bottom line recently, but is it going to develop revenue? You could look at out this absolutely free report displaying analyst income forecasts.

What About Dividends?

It is critical to take into consideration the overall shareholder return, as very well as the share cost return, for any supplied stock. While the share price tag return only reflects the adjust in the share price, the TSR contains the benefit of dividends (assuming they were reinvested) and the reward of any discounted capital elevating or spin-off. It’s fair to say that the TSR offers a additional finish picture for stocks that fork out a dividend. We notice that for International Small business Equipment the TSR over the past 5 several years was 12%, which is much better than the share cost return talked about higher than. This is mainly a outcome of its dividend payments!

A Various Point of view

When it is never ever nice to choose a decline, Intercontinental Company Devices shareholders can just take ease and comfort that , like dividends,their trailing twelve thirty day period loss of 2.4% wasn’t as bad as the current market loss of close to 12%. Extended expression buyers would not be so upset, because they would have produced 2%, each and every calendar year, about 5 years. It could be that the small business is just struggling with some quick expression issues, but shareholders ought to hold a close eye on the fundamentals. It really is constantly appealing to observe share price effectiveness in excess of the longer term. But to recognize International Organization Machines better, we require to take into consideration lots of other things. To that conclusion, you ought to be mindful of the 2 warning indicators we’ve spotted with Global Business Equipment .

If you are like me, then you will not want to miss this no cost listing of growing organizations that insiders are buying.

Be sure to take note, the sector returns quoted in this short article reflect the marketplace weighted regular returns of stocks that now trade on US exchanges.

Have suggestions on this write-up? Concerned about the content material? Get in contact with us directly. Alternatively, e mail editorial-workforce (at) simplywallst.com.

This report by Basically Wall St is common in mother nature. We offer commentary dependent on historic data and analyst forecasts only using an impartial methodology and our article content are not intended to be money tips. It does not constitute a suggestion to acquire or offer any inventory, and does not take account of your targets, or your financial predicament. We purpose to provide you very long-term concentrated examination pushed by basic details. Note that our assessment may perhaps not issue in the most current price tag-sensitive company bulletins or qualitative material. Simply Wall St has no posture in any stocks outlined.

More Stories

MLM Training Success- The MLM Success Secrets of the Right Warm Market Leads

How Can I Become a Successful Leader in the Mandura Business Opportunity

5 Website Publications You Can Use to Market Your Business