undefined undefined/iStock through Getty Illustrations or photos

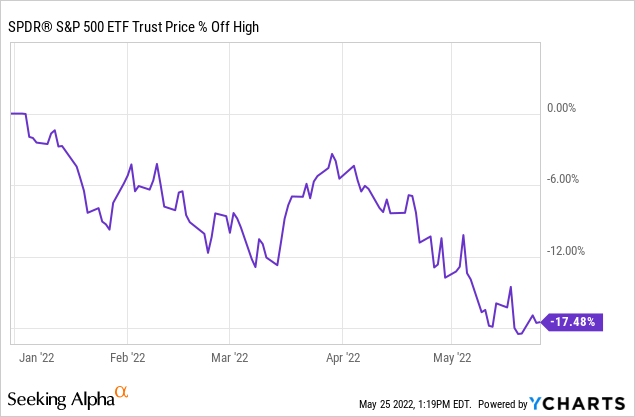

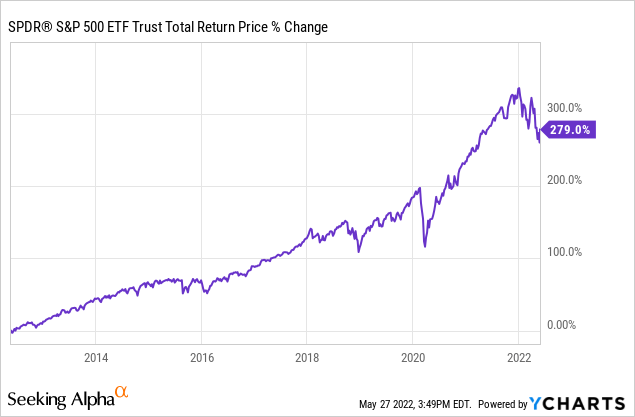

Following achieving refreshing all-time highs in early January, the S&P 500 (NYSEARCA:SPY) has plummeted to the level exactly where it is now flirting with bear industry territory. In fact, earlier this thirty day period it formally breached the 20% off of highs metric that is applied to officially label a bear marketplace:

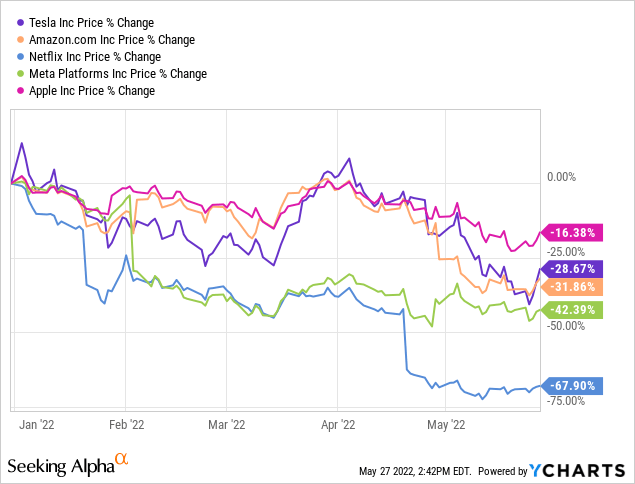

This decline has been led by sharp pullbacks in numerous huge tech giants this kind of as Tesla (TSLA), Amazon (AMZN), Netflix (NFLX), Meta (FB), and even Apple (AAPL):

While a scenario can unquestionably be made that the market has corrected enough as each and every of these tech titans have powerful money movement generation and are nonetheless putting up reliable effectiveness metrics with stellar aggressive positive aspects and equilibrium sheets, we imagine matters could also most likely get much worse ahead of they get greater. In this report we will explore four reasons why this could be the situation.

Cause #1: Much Decreased Interest Costs

One of the largest approaches that the Federal Reserve has fought past bear marketplaces was by decreasing the federal funds desire rates. This approach has established to be very helpful because – as Warren Buffett likes to say –

Curiosity premiums are like gravity in valuations. If interest prices are nothing at all, values can be almost infinite. If interest prices are very higher, which is a enormous gravitational pull on values… The most important product over time in valuation is obviously desire costs. Very low fascination costs make any stream of earnings from investments value additional money. Any financial investment is value all the income you happen to be likely to get out in between now and Judgment Day, discounted again. Nicely, the discounting back is influenced by which desire premiums you use.

The federal cash level is specifically impactful on the stock sector mainly because it is the desire level that depository institutions demand each other for overnight financial loans and is also the main basis for identifying the primary desire level, which in switch influences property finance loan loan rates, credit history card charges, and many other company and client bank loan fees. As a final result, anytime the Federal Reserve raises the federal money fee, it is expanding the price tag of income, thus shrinking its provide. Lowering the federal funds price has the reverse effect, expanding the financial source by lowering its price.

This has a double-effect on the stock market place. In addition to impacting the price cut charge for figuring out fairness valuations, it also impacts financial action. Larger desire costs normally cutting down client demand and expanding organization credit card debt servicing expenditures whilst lessen desire fees generally increase buyer desire and lessen small business financial debt servicing charges, encouraging them to borrow extra to make investments in enlargement initiatives.

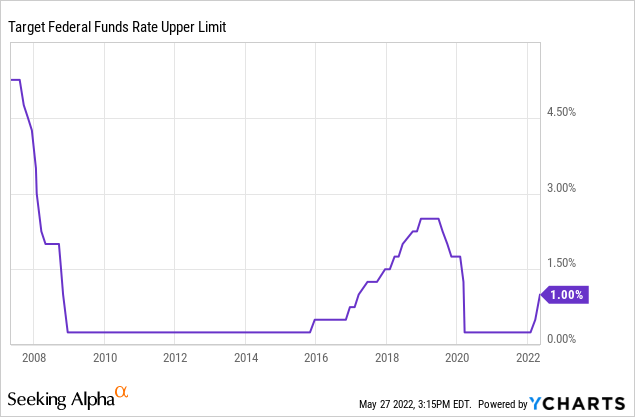

With this in mind, it is informative to be aware that in equally the runup to the 2008 crash and the 2020 crash, desire rates have been meaningfully higher than they are right now:

What this implies is that previous booms had been remaining sustained at a lot bigger fascination charges than the recent boom has been and that therefore the Federal Reserve experienced much more economic “ammunition” to fight people downturns by reviving the economic system via spectacular desire charge cuts. In distinction, the recent ecosystem only provides the Federal Reserve extremely minimal area to encourage the economic climate. In point, the Federal Reserve is chatting about elevating curiosity fees meaningfully even more, so the probability of an desire rate relevant stimulus to defeat the present-day downturn is really very low at the second. This usually means that the present-day downturn in the SPY could wind up getting substantially worse and most likely a lot additional extended than the final two.

Explanation #2: A lot Larger Inflation Costs

In addition to the desire amount similar headwind, inflation also poses a big menace to the present financial condition that could also direct to this downturn becoming a lot even worse and a lot more extended than the last two.

Related to curiosity premiums, high inflation gives a double unfavorable shock on the stock sector as it generally signifies that earnings for firms are eroded by way of lessened customer demand from customers and decreased profit margins though also pushing buyers to request large nominal complete return prospective from investments in purchase to crank out true returns (i.e., internet of inflation).

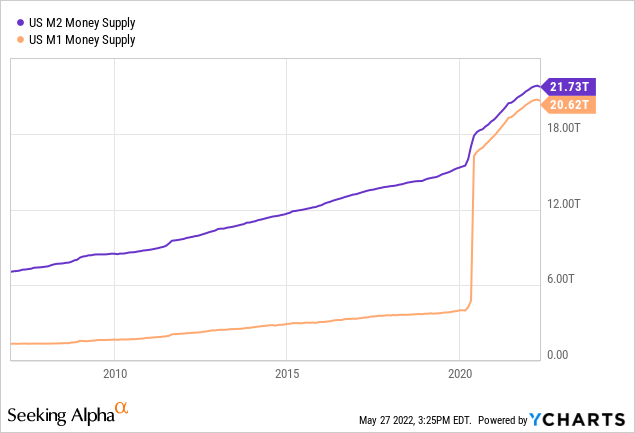

As an apart, it also has a pretty adverse affect on the Federal Reserve’s means to overcome an economic and/or inventory market downturn by means of slicing curiosity prices and printing income as individuals measures exacerbate inflation even more. In point, the Federal Reserve is working in direction of minimizing the sizing of its equilibrium sheet relatively than growing it further, which means that expanding quantitative easing to reflate the financial system is unlikely in the recent surroundings. This suggests that the Federal Reserve’s hands are largely tied here, stopping it from carrying out substantially to battle the latest downturn in distinction to the earlier two downturns when the govt engaged in enormous quantitative easing:

Cause #3: Larger Geopolitical Headwinds

It is no magic formula that geopolitical headwinds are increased currently than they had been in 2008. In addition to the war in Ukraine, the threat of war in East Asia, the Middle East, and probably expanding into a world-wide war or even nuclear war is probably better than it has ever been due to the fact the finish of the Chilly War. Palantir’s (PLTR) CEO Alex Karp said the other working day on CNBC that the probability of nuclear war is 20-30%, while Ray Dalio has frequently emphasized that we are transitioning into a new world purchase the place conflict concerning the founded terrific energy (the United States) and the climbing excellent energy (communist China) is expanding progressively probable.

Meanwhile, we are continue to working with stubbornly persistent COVID-19 flare-ups in strategic places these types of as Shanghai, China and the world appears headed for a meals lack due to fallout from the Ukraine war and lingering serious source chain challenges.

Although 2020’s crash was pretty much solely fueled by fears and uncertainty about the COVID-19 outbreak (which wound up staying mostly unfounded other than for the damaging impacts from authorities lock down steps), the very long-phrase headwinds from recent geopolitical headwinds are probably significantly far more serious. In particular is the fact that soaring geopolitical tensions usually means certainly reduced global trade and much larger governing administration expending (i.e., taxes and inflation), placing significant long-phrase burdens on the significant economies of the globe.

Rationale #4: A lot Larger Valuations

Very last, but not minimum, the valuations we are observing these days are significantly larger than they were being in the lead-ups to the 2008 and 2020 crashes.

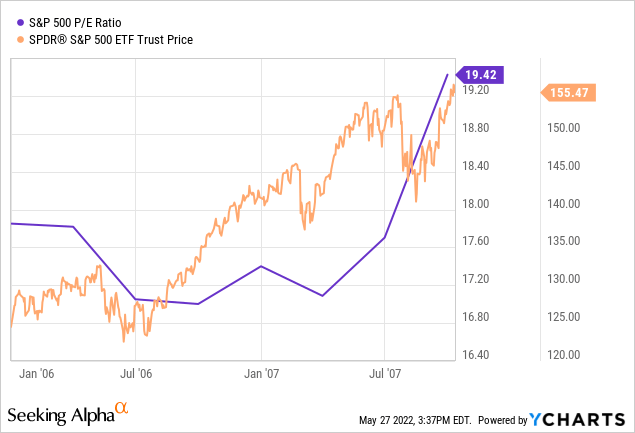

At its pre-crash peak in 2007, the S&P 500 traded at a P/E of less than 19.42x.

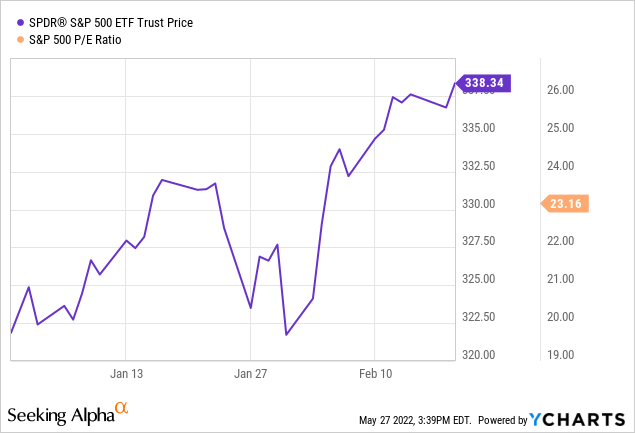

At its pre-crash peak in 2020, the S&P 500 traded at a P/E of 23.16x.

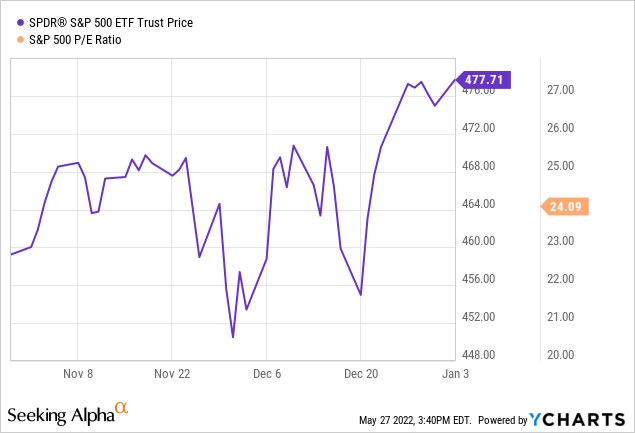

At its peak in advance of the recent pullback, the S&P traded at a P/E of 24.09x.

On top of that, the Buffett Indicator – a metric that compares the U.S. Industry Worth to its GDP – properly exceeded 200% on its latest peack, whereas it was in the neighborhood of 175% in early 2020 and just a little bit in excess of 150% at its the pre-2008 crash peak.

Investor Takeaway

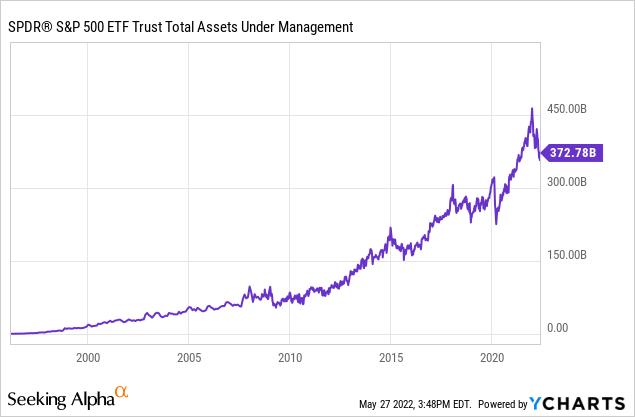

The SPY has been on a great run, combining minimal service fees (at present cost ratio is just .09%) with high liquidity to amass at its peak in excess of $450 billion in assets less than management.

Index investing has become wildly preferred with retail buyers and SPY has given them tiny cause to seem in other places, by approximately tripling investor cash around the earlier 10 years when featuring the most passive and liquid very diversified investment car on the world.

Having said that, with curiosity rates remaining near historic lows and very probably headed larger in the around term, inflation prices at 4 ten years highs, geopolitical headwinds at multi-ten years highs, and market place valuations near historic peaks, index investors in SPY could be in for a rude awakening.

As a consequence, we are diligently doing work to construct a portfolio of substantial quality dividend shares – a lot of of which have minimal correlation to SPY – in buy to established ourselves up for prospective outperformance in what could be some quite rocky years for the S&P 500.

More Stories

MLM Training Success- The MLM Success Secrets of the Right Warm Market Leads

How Can I Become a Successful Leader in the Mandura Business Opportunity

5 Website Publications You Can Use to Market Your Business